Interim Results - Responding to the impact of COVID-19 02 September 2020

2020 Interim Results

Responding to the impact of COVID-19

The Gym Group plc, the nationwide operator of 183 low cost, no contract gyms, announces its interim results for the six month period ended 30 June 2020. The results reflect a period of significant disruption in which the Company’s gyms were required by the UK Government to close on 20 March 2020 due to the COVID-19 outbreak. The gyms remained closed for the remainder of the reporting period before gyms in England re-opened on 25 July 2020.

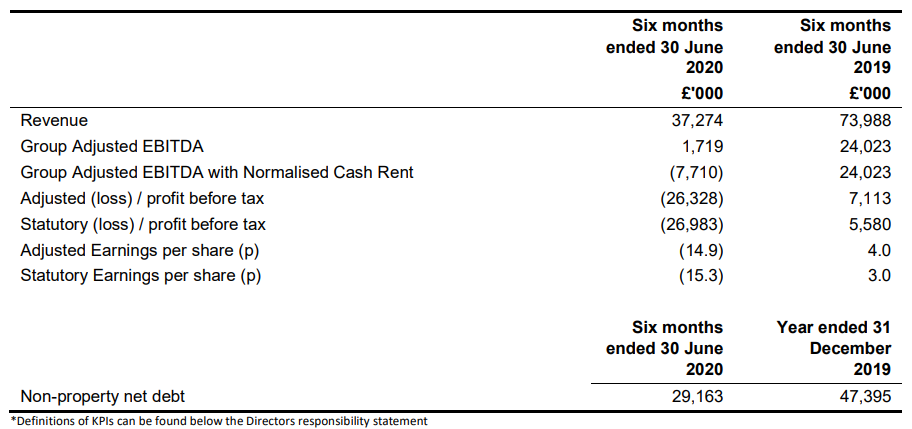

Financial Summary

Financial and Operational Update for H1 2020

- Strong January/February campaign, increasing membership levels to 891,000 as at 29 February 2020

- 4 new gyms opened in H1 2020 bringing total estate to 179 as at 30 June 2020

- Rapid lockdown of gym estate, following UK Government announcement; closed gyms on 20 March 2020, with cost reduction plans implemented to minimise cash outflows during closure

- Equity Placing completed with net proceeds of £39.9 million

- £30.0 million extension to existing £70.0 million Revolving Credit Facility agreed with lending banks

- Membership numbers decreased to 698,000 by 30 June 2020 (H1 2019: 796,000)

- Development of COVID-secure operating protocols in preparation for re-opening of gyms on 25 July 2020

Current Trading

- Estate now reopened nationwide; gyms in England re-opened on 25 July with gyms in Wales opening on 10 August 2020 and gyms in Scotland opening on 31 August 2020

- As at 25 July, prior to the first gyms re-opening, total membership was 658,000 members

- 4 new sites, which had been under construction prior to lockdown, opened during August, taking total number of sites opened in 2020 to 8 and total number of gyms in estate to 183

- As at 31 August 2020, total membership was 676,000 members; 639,000 paying members and a further 37,000 members on ‘free freeze’; average age of members is 32

- In the first five weeks of trading, the number of joiners was up 30% year-on-year and cancellations were up 6% year-on-year

- LIVE IT penetration at 22.3% at 31 August 2020 (Dec 2019: 18.9%)

- Gym visits growing week on week as member confidence increases;

- Non-Property Net Debt at 30 June of £29.2 million; liquidity headroom of £70.8 million within £100.0 million RCF

- Cash flow positive in August 2020 after re-opening on 25 July 2020

Richard Darwin, CEO of The Gym Group, commented:

“Following our decisive actions during lockdown to minimise costs and secure additional liquidity, we have reopened as the strongest capitalised company in the sector. Exacting new safety measures and innovative uses of technology have resulted in member numbers and gym usage growing since reopening as member confidence increases.

We anticipate the long-term structural growth of low-cost gyms will continue to be driven by the underlying interest in health and fitness, which is accelerating as a result of COVID 19 and the Government’s initiative to reduce obesity. With the likelihood of a challenging economic environment in the coming months, gym-goers will increasingly look for great value and as the lowest-priced high quality gym operator we are well placed to meet this demand.”

A conference call will be held for analysts and investors at 8.30am today. Please email leisure@instinctif.com for dial-in details or alternatively call Jack Devoy at Instinctif on 0207 427 1445.

An accompanying slide presentation to the conference call will be available from 9.30am at: /investors/results,-reports-presentations

FOR FURTHER INFORMATION, PLEASE CONTACT

The Gym Group

Richard Darwin, CEO

Mark George, CFO

via Instinctif Partners

Instinctif Partners

Matthew Smallwood

Justine Warren

020 7457 2020

Numis

Luke Bordewich

George Price

020 7260 1000

Peel Hunt

Dan Webster

George Sellar

020 7418 8900

1 179 as of 30 June 2020 (vs 175 at 31 December 2019) with four new sites opened in H1 2020

Forward-looking statements

This announcement includes statements that are, or may be deemed to be, "forward-looking statements". By their nature, such statements involve risk and uncertainty since they relate to future events and circumstances. Actual results may, and often do, differ materially from any forward-looking statements. Any forward-looking statements in this announcement reflect management’s view with respect to future events as at the date of this announcement. Save as required by law or by the Listing Rules of the UK Listing Authority, the Company undertakes no obligation to publicly revise any forward-looking statements in this announcement following any change in its expectations or to reflect subsequent events or circumstances following the date of this announcement.